The Rising Importance of CEO Fraud Detection in Business

Introduction to CEO Fraud

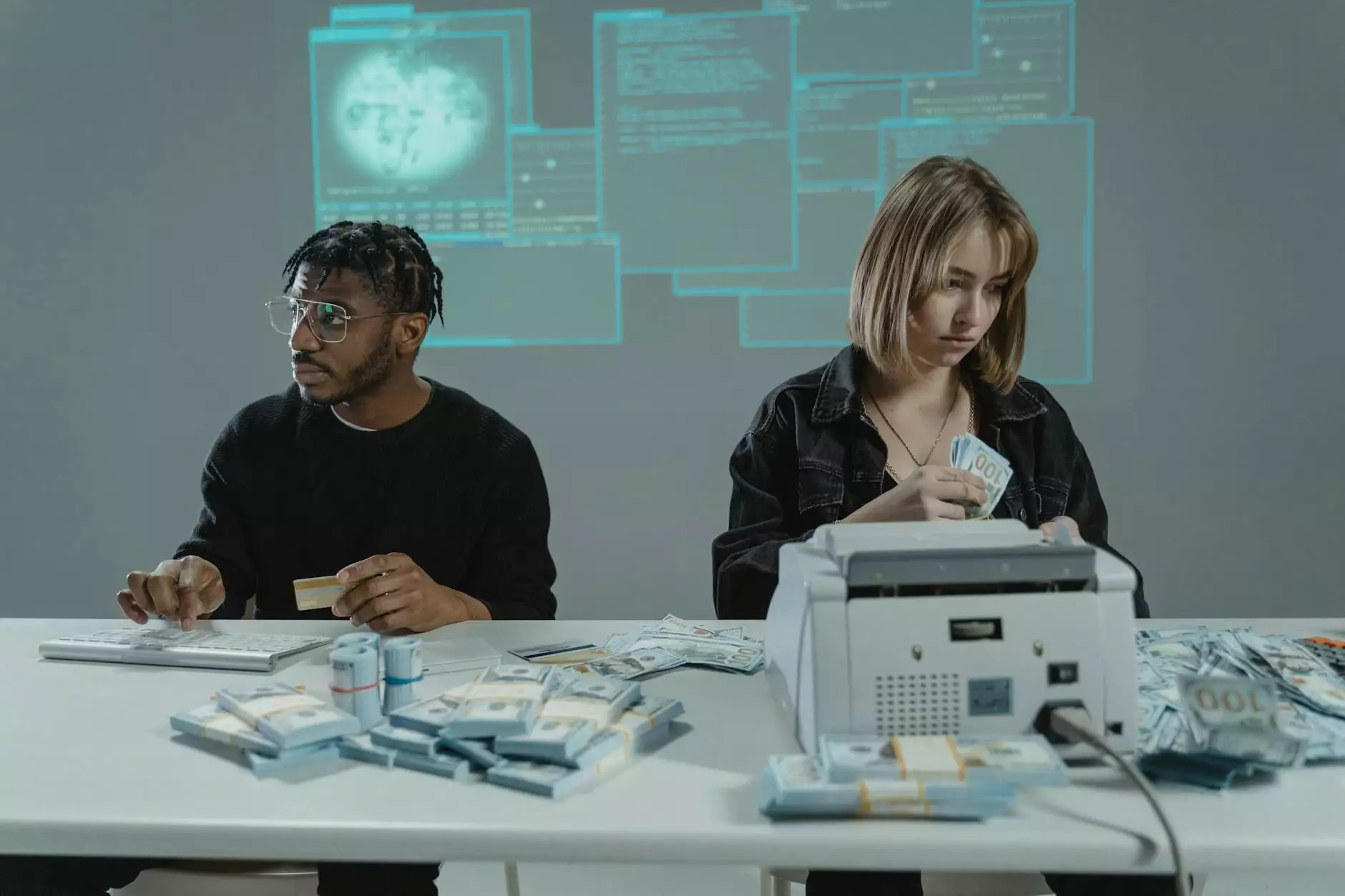

In today's digital landscape, the threat of fraud has escalated dramatically, particularly within the realm of corporate governance. CEO fraud, often referred to as business email compromise (BEC), poses significant risks to companies of all sizes. Defined as a type of cyber deception where attackers impersonate a company’s CEO or another executive to manipulate employees into transferring money or sensitive data, CEO fraud is not only costly but also damaging to reputation.

Understanding CEO Fraud Detection

CEO fraud detection involves implementing a range of techniques and strategies designed to unmask fraudulent activities before they can be executed. This requires vigilance, the right technology, and a comprehensive strategy that includes employee training and robust cybersecurity measures.

The Evolution of Fraud in the Corporate World

As technology evolves, so too do the tactics employed by fraudsters. The rise of digital communication has given birth to new strategies for conducting fraud, such as phishing emails that appear to come from high-level executives. These fraudulent communications exploit trust, often leading to significant financial losses for organizations.

The Mechanics of CEO Fraud

CEO fraud typically employs psychological manipulation and social engineering techniques. Cybercriminals research their targets extensively, obtaining information about the company’s operations, executives, and even employee roles. Once they have enough information, they craft convincing messages that can easily deceive employees into acting against their best interests.

Why is CEO Fraud Detection Crucial?

The consequences of falling victim to CEO fraud can be dire. Aside from financial loss, the fallout includes:

- Reputational Damage: Trust is paramount in business; a fraud incident can erode stakeholder confidence.

- Operational Disruption: The aftermath of fraud can disrupt normal business operations, leading to inefficiencies.

- Legal Ramifications: Companies may face lawsuits or regulatory scrutiny if they fail to safeguard data.

- Financial Loss: Estimates suggest that organizations can lose millions in a single incident.

Strategies for Effective CEO Fraud Detection

To safeguard against CEO fraud, it is essential for businesses to adopt a multi-layered approach that includes both technological and human factors. Here are some effective strategies for CEO fraud detection:

1. Employee Education and Awareness

One of the first lines of defense against CEO fraud is a well-informed workforce. Employees should be trained to recognize the signs of suspicious communications and understand the importance of verifying requests—especially those that involve money transfers or sensitive information.

Regular training sessions and awareness campaigns can reinforce the idea that fraud detection is everyone’s responsibility.

2. Email Authentication Protocols

Implementing email authentication protocols such as SPF (Sender Policy Framework), DKIM (DomainKeys Identified Mail), and DMARC (Domain-based Message Authentication, Reporting & Conformance) can help prevent fraudulent emails from reaching employees. These technologies ensure that emails are actually sent from the verified sources they claim to represent.

3. Verification Processes

Establishing strict verification processes for any requests, especially those involving financial transactions, is critical. This might involve:

- Using two-factor authentication for transactions.

- Requiring direct confirmation through a phone call or in-person meeting before executing any requests made via email.

- Implementing a company policy that mandates multiple approvals for significant transactions.

4. Utilize Advanced Fraud Detection Software

Investing in CEO fraud detection software can significantly enhance a company's ability to identify potential threats. Tools with machine learning capabilities can analyze communication patterns and flag anomalies. These systems can be integrated with existing email systems to monitor incoming and outgoing messages for signs of fraud.

5. Monitor Financial Transactions

Companies should employ robust monitoring systems for their financial transactions, looking for any unusual activities or red flags. Automated systems can provide alerts for transactions that deviate from normal patterns, allowing for timely investigation and potential intervention.

6. Implement Strict Access Controls

Limiting access to sensitive information and financial systems can reduce the likelihood of unauthorized transactions. Implementing role-based access controls ensures that only authorized employees can execute critical operations, further mitigating risks associated with CEO fraud.

Case Studies: The Impact of CEO Fraud

To appreciate the severity of this issue, one needs to look at various case studies where CEO fraud has been successfully executed:

Case Study 1: The Billion Dollar Scandal

A prominent technology firm fell victim to a sophisticated CEO fraud scheme, resulting in a loss of over $100 million. The fraudsters sent emails that appeared to originate from the CEO, instructing the finance department to wire funds to a foreign account. It was discovered that the attackers had spent weeks gathering information about the company and its executives.

Case Study 2: The Retail Giant Incident

A large retail organization experienced a similar incident where a fake invoice was sent, leading to the transfer of funds to a fraudulent account. The consequences were not just financial; the company also faced public scrutiny and loss of customer trust.

The Future of CEO Fraud Detection

As technology continues to develop, so will the tactics of cybercriminals. Consequently, CEO fraud detection must evolve. The integration of artificial intelligence (AI) and machine learning in fraud detection systems promises to enhance the chances of identifying fraud attempts before they can manifest financially.

Moreover, regulatory bodies are increasingly scrutinizing cybersecurity protocols within organizations, making it imperative for businesses to prioritize fraud prevention strategies.

Conclusion: A Call to Action

In conclusion, CEO fraud poses an ongoing threat to businesses that must be taken seriously. The consequences of falling victim can be devastating, but by implementing comprehensive fraud detection strategies and fostering a culture of security awareness, companies can better protect themselves. The challenge lies not only in deploying advanced technologies but also in empowering employees to act as the first line of defense against fraud.

Stay vigilant, invest in training, and adopt the best tools available to enhance your organization’s resilience against CEO fraud.

Contact Us for More Information

If you're looking to improve your organization’s CEO fraud detection capabilities, consider partnering with experts in the field. At Spambrella.com, we are dedicated to providing the best IT Services & Computer Repair and Security Systems to help safeguard your business. Contact us today to learn more about how we can assist you in fortifying your defenses against fraud.

© 2023 Spambrella - All Rights Reserved.